What Is Rapital Capital and How Does It Work?

While investigating loaning and supporting choices, it’s fundamental to pick a supplier that figures out individual requirements. Rapital Capital, a monetary administrations organization, has situated itself as a dependable player in the transient loaning industry. Whether you’re confronting surprising costs or looking for fast money to oversee quick requirements, Rapital Capital offers a smoothed out loaning cycle to ease monetary weights.

What Is Rapital Capital?

Rapital Capital is a monetary administrations organization spend significant time in momentary credits intended to assist people with meeting dire monetary requirements. Dissimilar to conventional loan specialists that frequently have extensive endorsement processes, Rapital Capital plans to furnish borrowers with a quick, bother free method for getting to reserves.

The organization’s administrations are customized to individuals who might not areas of strength for have accounts but rather need assets to cover crises, bills, or other squeezing monetary commitments. By offering credits with adaptable terms, Rapital Capital has turned into a go-to moneylender for those needing cash.

How Does Rapital Capital Work?

Rapital Capital works through a clear web based loaning stage. The interaction regularly includes four key stages:

1. Application Process

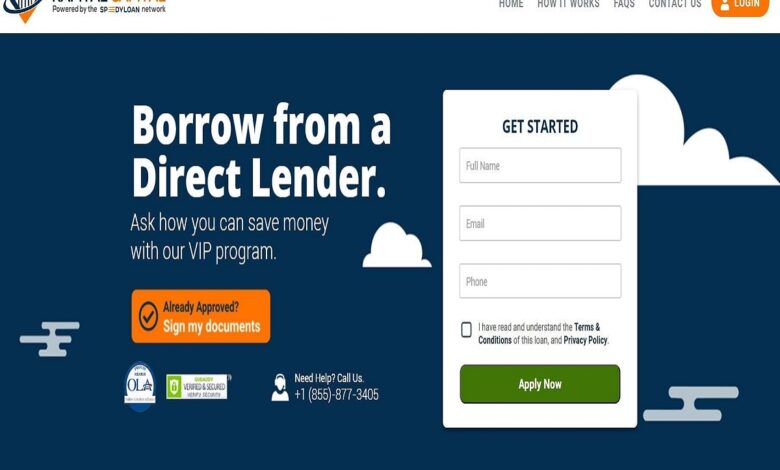

Borrowers start by finishing a web-based application structure, which incorporates insights concerning their personality, work status, pay, and banking data. Rapital Capital underscores straightforwardness, making the structure simple to finish up and submit in practically no time.

2. Eligibility Assessment

When the application is submitted, Rapital Capital assesses the borrower’s qualification. Factors like pay level, capacity to reimburse, and monetary history are thought of. Not at all like conventional banks, the organization doesn’t exclusively depend using a credit card scores, making advances more open.

3. Loan Approval

Assuming the application meets the standards, Rapital Capital endorses the credit. Borrowers are regularly educated regarding their endorsement status in no time, guaranteeing they don’t need to stand by lengthy to get to reserves.

4. Fund Disbursement

Endorsed advances are saved straightforwardly into the borrower’s ledger, frequently as fast as the following work day. This quick asset payment settles on Rapital Capital a favored decision for people managing crises.

Features of Rapital Capital Loans

Rapital Capital’s allure lies in its exceptional credit contributions and borrower-centered administrations. A portion of the key highlights include:

Fast Endorsement:

The endorsement interaction is quick, with negligible administrative work required.

No Severe Acknowledge Check:

Borrowers with unfortunate record can in any case meet all requirements for credits.

Straightforward Terms:

The organization gives clear terms in regards to reimbursement timetables and loan costs.

Helpful Internet based Admittance:

Applications and credit the executives should be possible completely on the web.

Benefits of Using Rapital Capital

Selecting Rapital Capital accompanies a few benefits that put it aside from customary loan specialists:

1. Accessibility for Diverse Borrowers

Rapital Capital takes special care of a wide crowd, incorporating people with not exactly wonderful credit. This inclusivity guarantees that more individuals can get to monetary guide when they need it most.

2. Emergency Support

Crises can emerge startlingly, and Rapital Capital’s fast completion time gives a monetary wellbeing net during such circumstances.

3. Straightforward Process

The easy to understand online stage works on advance applications, permitting borrowers to keep away from the pressure of extensive administrative work.

4. Transparency

Rapital Capital guarantees that borrowers comprehend credit terms forthright, staying away from stowed away expenses or surprising charges.

Conclusion

Rapital Capital stands apart as a helpful and open moneylender for people requiring diminutive term monetary alleviation. Its borrower-accommodating strategies, quick credit handling, and straightforwardness go with it a trustworthy decision for taking care of crises. Notwithstanding, similar to any monetary choice, it’s fundamental to figure out the terms and guarantee the advance lines up with your reimbursement capacity.